The latest painful chapter in the JCPenney saga has now been written.

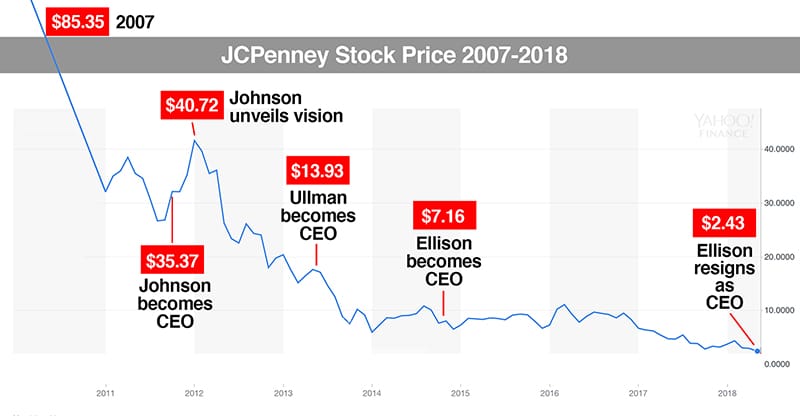

CEO Marvin Ellison resigned a couple of weeks back—with the company’s stock price down to a mere $2.43. That’s a particularly brutal number, considering that in 2007 a share of JCP went for $85.

Technically, this plummet was co-authored by three CEOs serving four terms—Marvin Ellison, Ron Johnson and two stints by Myron Ullman.

By numbers alone, it’s hard to tell who was worse. The stock plunged 65% under Ullman (Act I), 54% under Johnson, 58% under Ullman (Act II) and 66% under Ellison.

So I was surprised that Ellison received the praise of many writers reporting his resignation. “He helped turn around J.C. Penney,” said The Street. In what universe that happened may never be known.

Not only do the writers let Ellison off the hook, they seem to rally under a common theme: it’s all Ron Johnson’s fault. After all, Ron was in and out in less than two years, and the stock was decimated during his reign.

However, this narrative ignores two major facts. First, JCP had already lost more than half its value before Johnson took the reins. Second, Ullman and Ellison succeeded only in driving JCP further into the ground.

The truth is, Johnson’s vision was correct and necessary. History has now proven that JCP was (and is) doomed without a radical plan for reinvention.

The company committed the classic sin of throwing out the baby with the bathwater.Continue reading…