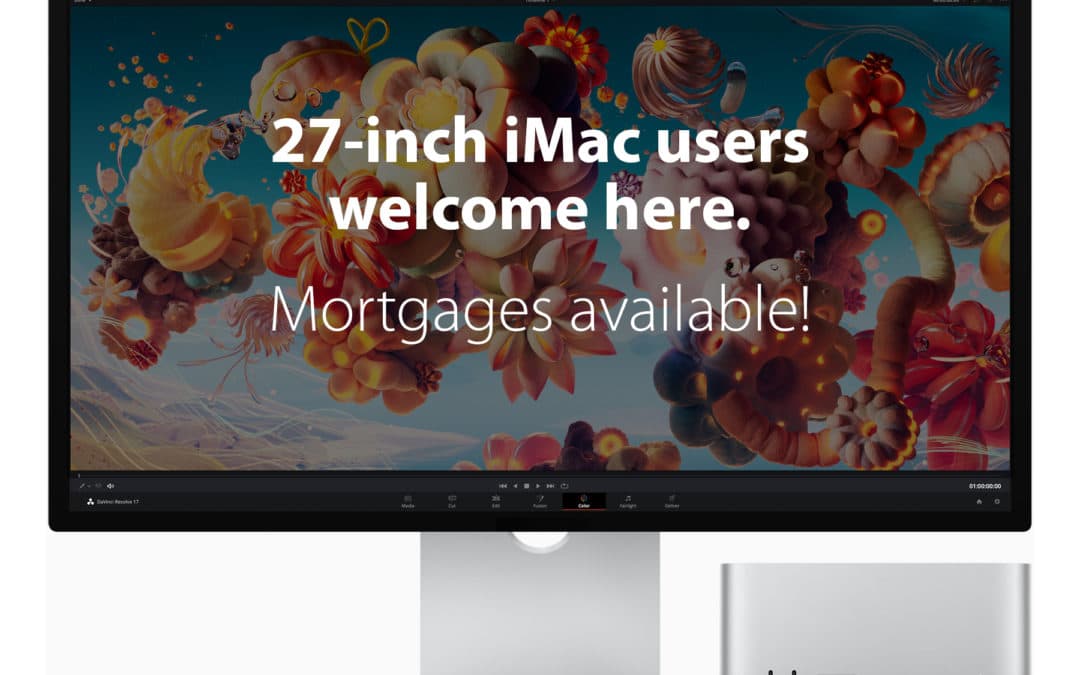

Allow me to speak on behalf of the world’s 27-inch iMac owners:

THIS IS AN OUTRAGE!

Ah. Good. Had to get that out of my system. Honestly, I have never been so appalled at an Apple strategy. Between the launch of Mac Studio and the simultaneous death of iMac 27, we who have so patiently waited for an Apple Silicon-powered 27-inch iMac are suddenly left with only two options.

We can hang onto our aging computers and simply hope that a new iMac 27 will one day appear. Or we can spend more than double the cost of a typical new iMac 27 for a Mac Studio + Studio Display.

There are only two ways to explain what Apple is doing. It is either failing the transparency test miserably, or it is blatantly committing an act of corporate greed. Sadly, “all of the above” is also a possibility.

Continue reading…